Labour’s first budget meets with mixed response

Chancellor Rachel Reeves delivered the Labour government’s first budget during their latest term in office this week, announcing an investment of more than £5bn to deliver its housing plans.

Over £1bn would go towards accelerating the remediation of unsafe residential buildings, with £3bn in housing guarantee schemes to support SME housebuilders and the Build to Rent sector.

The Affordable Homes Programme fund is also increased to £3.1bn to boost the supply of thousands of new homes.

Reeves also confirmed the appointment of new planning officers to support the currently failing system, with £46m of additional funding set aside to recruit and train 300 graduates and apprentices in local planning authorities, and accelerate large sites “stuck in the system”.

However, National Insurance rises, capital gains increases and a rise in the minimum wage mean that many firms will be left trying to find additional funds to cover the cost, with Construction Enquirer reporting frustration from many in the sector.

There was also little in demand-side initiatives to boost the housing market which came as a disappointment to many, especially with the Home Builders Federation (HBF) highlighting that the previous Help to Buy equity loan scheme is set to deliver a return on investment for tax payers of more than £2bn.

The HBF’s Road to Redemption report reveals that Help to Buy, introduced in 2013, supported almost 400,000 buyers to buy an energy efficient new build home, and created an “unparalleled period of housing supply growth”.

The HBF is repeating its call to government to introduce a new equity loan scheme, supported by developer contributions.

The Help to Buy scheme supported the fastest increase in housing delivery on record and the positive returns it is now generating for taxpayers shows that intervening to support first-time buyers, as governments have done for decades, can have widespread social and economic benefits.

Neil Jefferson, CEO, HBF

Annual house price growth slows in October

The latest house price index from mortgage lender Nationwide has found that annual house price growth has dropped from 3.2% in September to 2.4% in October.

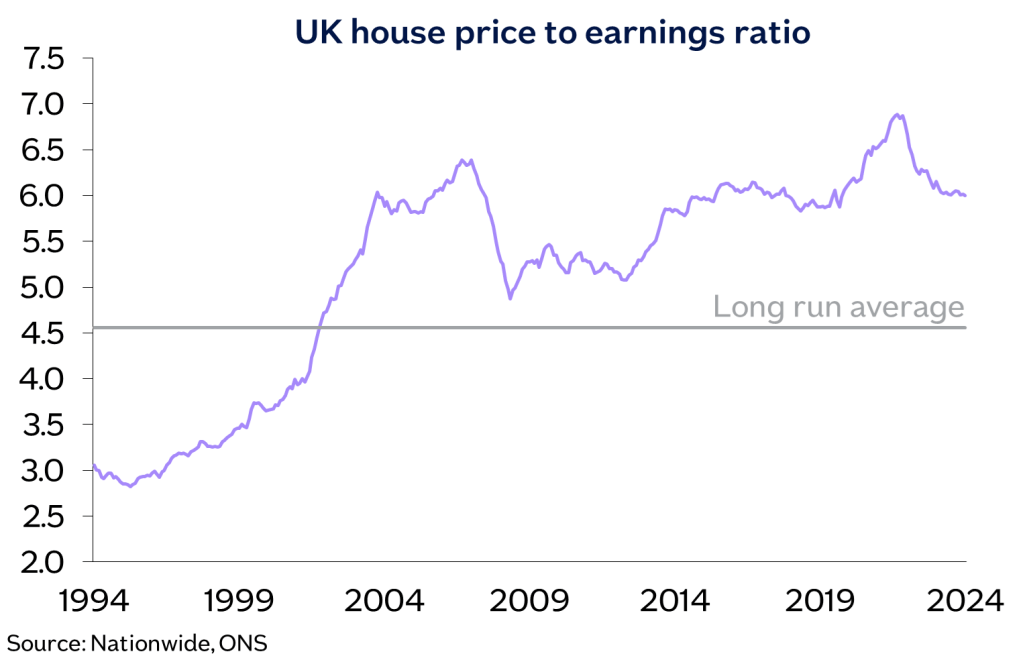

The average property value grew by 0.1% in the month to reach £265,738, with the UK house price to earnings ratio falling to around 6.0.

Providing the economy continues to recover steadily, as we expect, housing market activity is likely to continue to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth.

Robert Gardner, Chief Economist, Nationwide

Construction to grow by 2.5% next year

The latest Autumn forecast from the Construction Products Association has revealed “cautious optimism” in the sector, with total construction output forecast to rise by 2.5% in 2025 and 3.8% in 2026, after falling by -2.9% this year.

Private housing output is set to fall by -9.0% in 2024, but rise by 8.0% in 2025.

Commenting on the Autumn Forecasts, CPA Economics Director Noble Francis said: “Construction has suffered a very challenging period over the past two years, with sharp downturns in the two largest sectors, private housing new build and repair, maintenance and improvement.

However, cautious optimism appears to be creeping back into the industry. Broader UK economic growth, helped by lower interest rates and sustained real wage growth, combined with a stable government, appears to be leading to improving consumer and business investment.”