Number of construction-related deaths higher than five-year average

The Health and Safety Executive has published its latest construction statistics report, showing that in the year to March 2024 there were 51 fatalities in the industry; higher than the five-year average of 42.

The report also found that over the past three years, an average of 78,000 workers per year are suffering from work-related ill health and 47,000 construction workers per year are sustaining injuries at work.

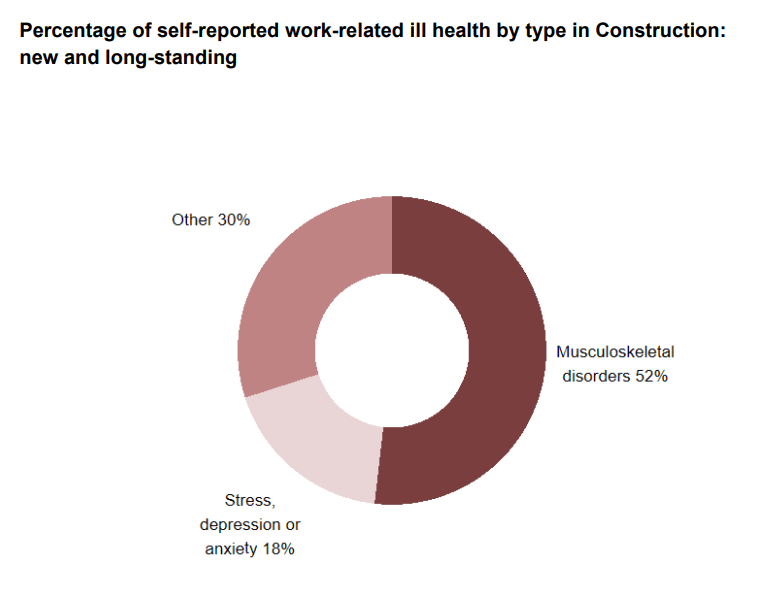

Over half of those suffering from ill health have musculoskeletal disorders, with 18% suffering from stress, depression or anxiety – a condition prevalent within the industry, with two construction workers taking their own life every day.

House prices rise in the year to September

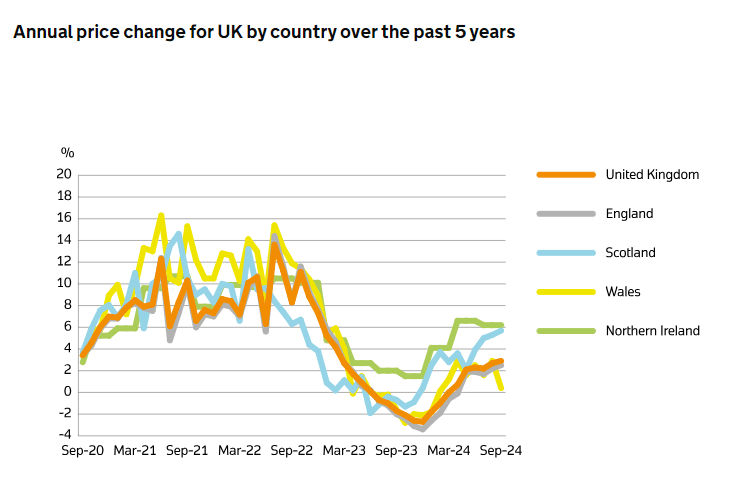

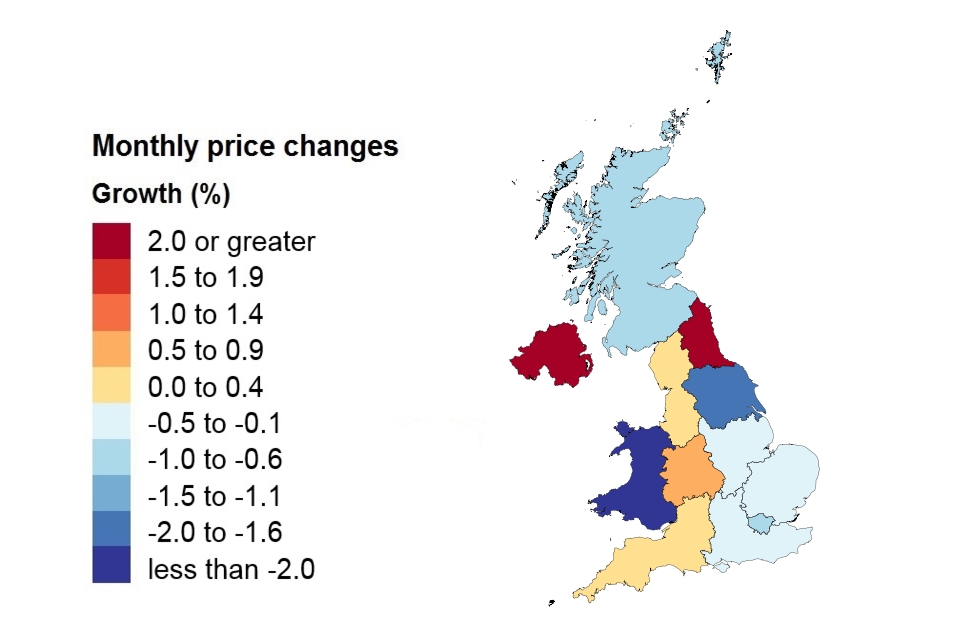

Latest data from the Office for National Statistics has revealed a 2.9% increase in property prices over the twelve months to September.

The price of a typical home now stands at £292,000, a -0.3% reduction in the month.

The annual rate of growth was highest in the North East, at 6.5%. London experienced a fall in house prices over the year, at -0.5%.

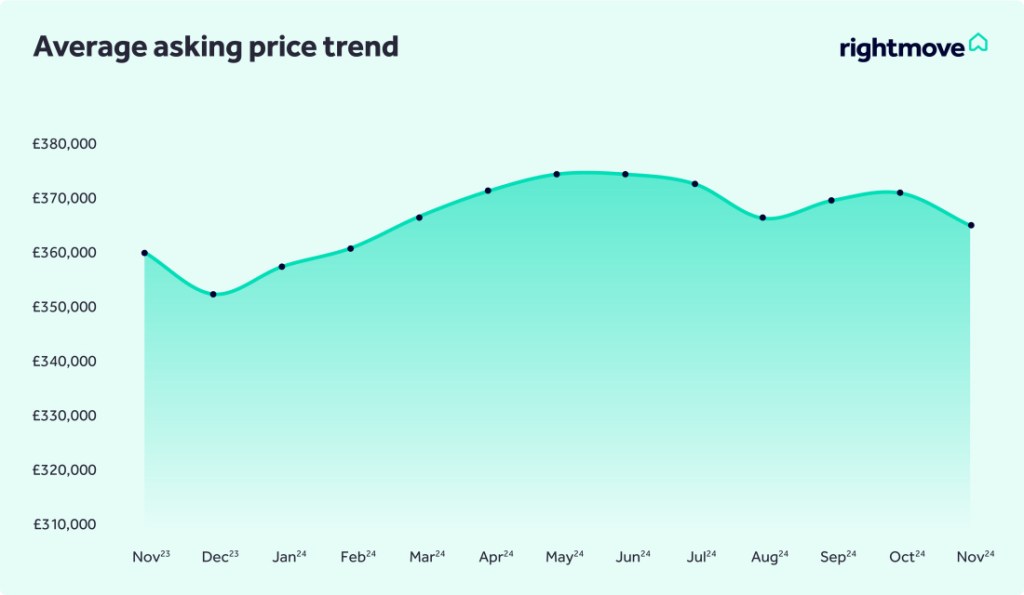

Meanwhile, Rightmove has reported that average new seller prices fell by -1.4% in November, with a typical UK property valued at £366,592.

The fall was larger than the usual -0.8% drop seen this time of year, with the property website citing “pre and post-Budget jitters” as the key reason.

However, market activity remains stronger than last year, with the number of new sales being agreed remaining at 26% higher than 2023.

The firm also predicted that house prices would rise by 4% in 2025; their highest prediction since 2021.

Crest profit at “lower end” of expectations

Crest Nicholson has published an update for the year ending 31 October 2024, stating that year-end profit is likely to be at the “lower end” of guidance, blaming a higher proportion of affordable homes delivery and low margin sites.

The housebuilder has said that adjusted pre-tax profit will be around £22m – £29m.

Meanwhile, just 1% of Ilke Homes creditors are expected to recover their share of the £321m debt following the firm’s liquidation.

The vast majority of companies owed money will not see a penny, with Homes England the only organisation set to recover any cash.

Housing association spend drops below forecast

The most recent quarterly survey by the Regulator of Social Housing has found that English housing association spend was -28% below forecast in the quarter to 30 September 2024.

Registered providers spent a total of £3.2bn in the three month period, below the £3.4bn average spent per quarter over the past three years.

The Regulator of Social Housing said: “In addition to general scheme delays, providers have experienced planning issues and legal delays entering into contract, and insolvency amongst contractors continues to be reported.

“Where delays have occurred, the majority of providers have re-profiled expenditure into the following four quarters, although in a minority of cases expenditure has been deferred for over a year. A small number of providers have also reported new developments being placed on hold as a result of uncertainty over the availability of grant funding.”