HBF report highlights S106 challenges

A report by the Home Builders Federation (HBF) has found that over 17,000 affordable homes are on hold due to uncontracted Section 106 units and a lack of bids from housing associations.

The paper, Bid Farewell, has revealed that at least 139 developments have stalled, with a lack of registered providers in the market contributing to a “perfect storm” of economic and policy pressures.

Many local authorities require a percentage of homes on private housebuilding sites to be affordable units, which are then purchased by registered providers at a reduced price; but a lack of Section 106 bids has forced housebuilders to grind work to a halt.

Most registered providers are having to invest heavily in building safety remediation and existing stock, which has reduced their ability to bid for new properties.

However, Homes England has launched a service to connect housebuilders and housing associations in an effort to address this problem.

The Section 106 Affordable Housing Clearing Service allows developers to submit details of affordable homes they have planning permission for but which remain uncontracted. This can then be viewed by local authorities and housing associations.

However, the HBF and National Housing Federation have both expressed concern that this database – whilst welcome – will not solve the key issue preventing registered providers from bidding, citing financial capacity and funding as the main challenge.

Meanwhile, Housing and Planning Minister Matthew Pennycook has said that the amount of grey belt land released will likely be lower than initial estimates.

Speaking in front of the House of Lords built environment committee this week, Pennycook said that he would not put a figure on how much land would be released, although he did say it would probably be less than 10% of overall green belt land.

He said: “We’re only talking about releases where local authorities are unable to meet assessed housing needs through brownfield development alone, but where it does need to be released, it will be based on a local figure, and that will differ in lots of different areas.

“I’m quite happy to say we don’t think it will be a significant quantity of land, but it will be a modest amount of land that does make a difference.”

Home Building Fund extended as SMEs sound alarm

The Ministry of Housing, Communities and Local Government (MHCLG) has confirmed that the Home Building Fund for smaller developers has been extended beyond March next year, with up to £700m available to support the construction of around 12,000 new homes.

The MHCLG says that the move will allow SME housebuilders to “play a crucial role in the Government’s Plan for Change to build 1.5 million new homes over five years”.

The fund was originally due to close on 31 March 2025, and provides a range of financial support for smaller developers in England struggling to access finance.

They must be the bedrock of our plans. That is why I’m extending the fund so more of them can access the capital and investment needed to deliver thousands of new homes across the country and help us fix the housing crisis for good.

Angela Rayner, Deputy Prime Minister and Housing Secretary

Meanwhile, the Federation of Master Builders (FMB) has published a report from the London School of Economics & Political Science to support its campaigning for smaller developers.

The report, Supporting SME Housebuilders: Challenges and Opportunities, states that smaller housebuilders will not be able to increase their current 10% market share until certain barriers are removed.

These include the complex planning system, difficulty accessing suitable and affordable land, and insufficient access to affordable funding. The report suggests several recommendations for change, including streamlining the planning process, providing Government-backed low-interest loans, and a greater focus on apprenticeships and training.

Housing market beat expectations in 2024, says Halifax

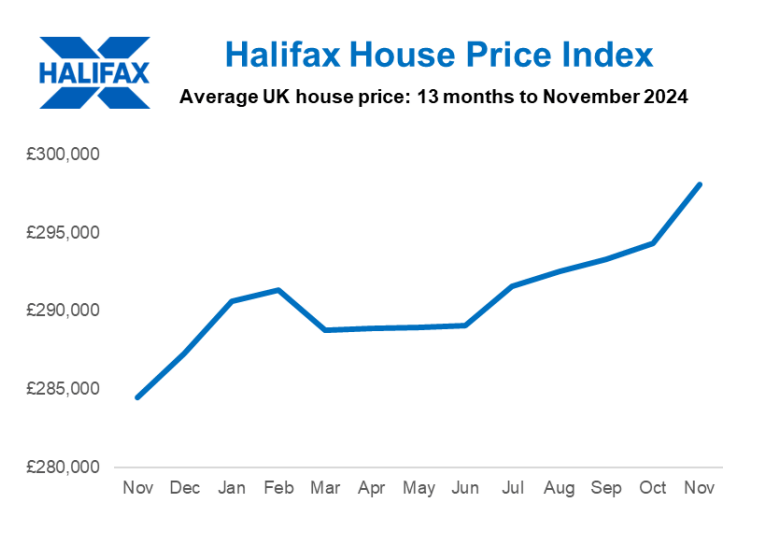

Mortgage lender Halifax has published its housing market review for 2024 and outlook for 2025, stating that the market “beat expectations in 2024”, with recovery supported by lower mortgage rates and strong wage growth.

The review also notes an annual growth of 4.8%, with property prices reaching a record high of £298,083 compared to £284,442 a year ago; an increase of £13,641.

The typical UK house price has increased by 56% over the last decade – a rise of £106,845.

The firm expects “modest” house price growth next year, with a range of 0% to 3% expected for 2025.

Miller buys St Modwen

Miller Homes is to buy St Modwen Homes in a deal set to complete in the first quarter of 2025.

The purchase forms part of Miller Homes’ strategy to grow to 6,000 homes annually. St Modwen will continue to operate under its brand and will set up a new regional office in the South West of England.

Miller Homes’ ceo Stewart Lynes, said: “Across the UK, people need high-quality, sustainable homes. We are committed to growth and playing an important part in addressing the housing shortage. We were attracted to the quality and location of St. Modwen Homes’ land, helping us grow and expand to new areas.”