HBF report reveals downward trend

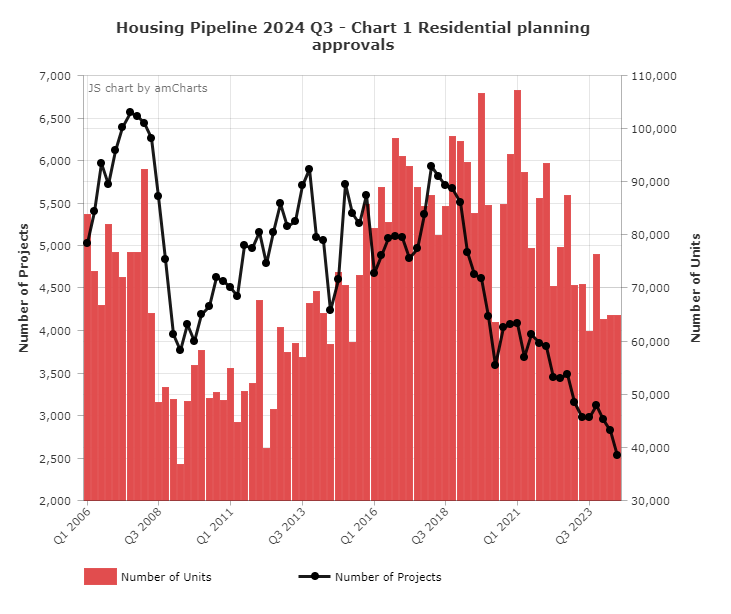

The latest Housing Pipeline Report from the Home Builders Federation (HBF) for Q3 2024 has revealed that planning approvals for both sites and units have continued their downward trend.

Around 2,260 sites were approved between July to September, a -10% fall on the previous quarter and the lowest quarterly total since the Pipeline reports began in 2006.

During the third quarter, approved units rose 2% to 57,356 – but this was 40% below the peak. The rolling annual total of 240,661 units was a slight 1% improvement on the second quarter of 2024, but -6% lower than the same period in 2023.

The HBF warned that planning approvals would now need to increase by more than 150% to meet the Government’s target of 370,000 new homes a year.

Neil Jefferson, Chief Executive Officer for the HBF, said: “The continued decline in planning approvals is deeply concerning and underlines the scale of the challenge we face in addressing the country’s housing crisis.

“We are seeing significant regional variation, with some areas experiencing severe drops in approvals, while others, like London, are still well below previous levels. This discrepancy highlights the need for targeted interventions that not only speed up planning processes but also provide clear support for both developers and homebuyers.”

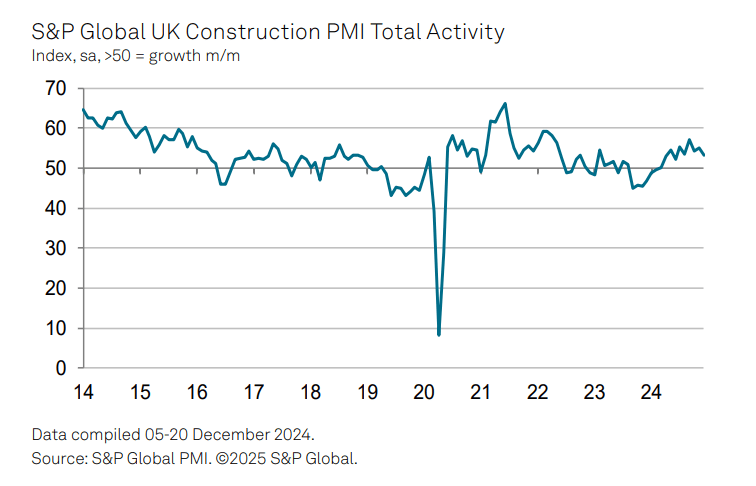

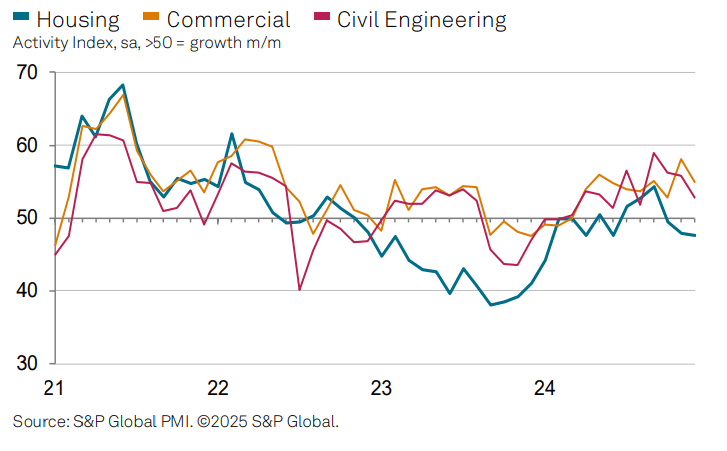

Construction recovery loses momentum

The latest monthly Purchasing Managers’ Index from S&P Global has revealed construction activity in December 2024 growing at the slowest pace since last June.

The headline index registered 53.3 in December, down from 55.2 in November, and the lowest rating for six months.

Residential work registered an overall decline in output during December, at 47.6. Housing activity has now decreased for three consecutive months, and the latest reduction was the fastest since June 2024.

Respondents cited weak consumer confidence, subdued demand and elevated borrowing costs as the key drivers for the decline.

Churchill revenue falls as Bloor profits drop

Churchill Living’s have experienced a fall in both revenue and profit in its financial year ending 30 June 2024.

The retirement housebuilder’s revenue fell by -14.3% against 2023 to £149.4m, with profit slumping to £3.9m (2023: £149.4m).

Spencer McCarthy, Churchill’s Chairman and Chief Executive Officer, slammed a “broken planning system which is in urgent need of reform”.

Meanwhile, Bloor Homes has warned of a “challenging landscape” as it reported a drop in pre-tax profit and turnover.

The firm reported profit of £208.2m for the year to 30 June 2024, down -27% on the previous year (£286.8m). Turnover fell from £1.35bn to £1.25bn over the same period.