Knight Frank report highlights ongoing industry challenge

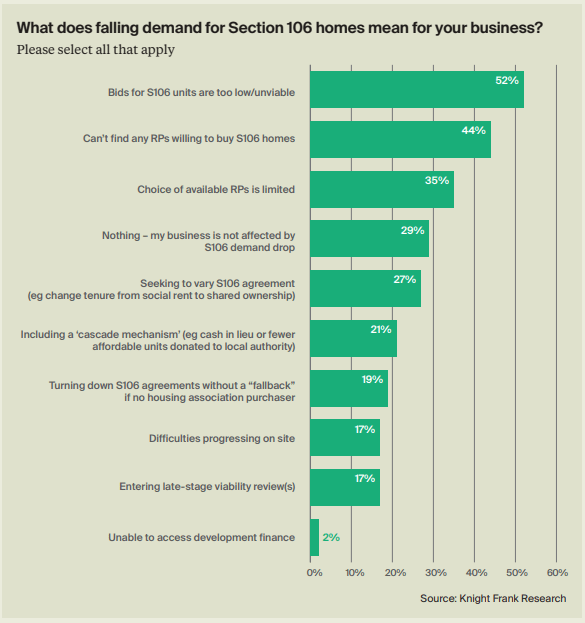

The most recent Residential Development Land Index report by real estate agency Knight Frank has placed renewed emphasis on the housing industry’s struggle to find registered providers willing to bid on Section 106 homes.

The report, which covers Q4 2024, found that over half of survey respondents found that bids for S106 units were too low or unviable, and just over 40% reported that they could not find any registered providers willing to buy S106 homes.

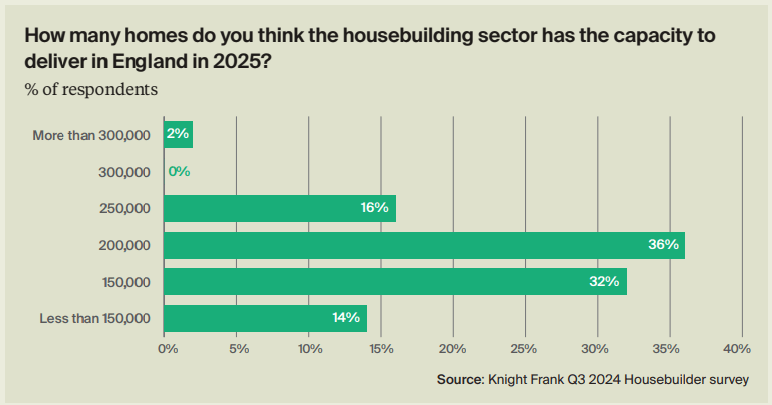

The survey of around fifty SME and large housebuilders also revealed that just a third of respondents believed that the housing sector could deliver 200,000 units this year, with 14% predicting that fewer than 150,000 homes would be built in 2025.

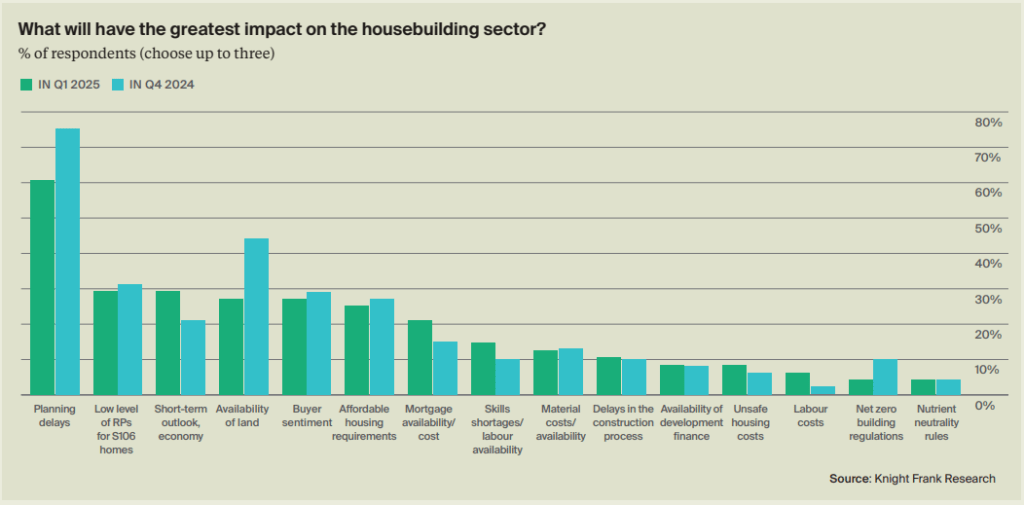

However, recent updates to the National Planning Policy Framework and a renewed government approach to the planning system saw a reduced proportion of respondents noting planning delays as the biggest pressure on their business, falling to 60%; the lowest level in four years.

Sales activity remains robust as house price growth slows

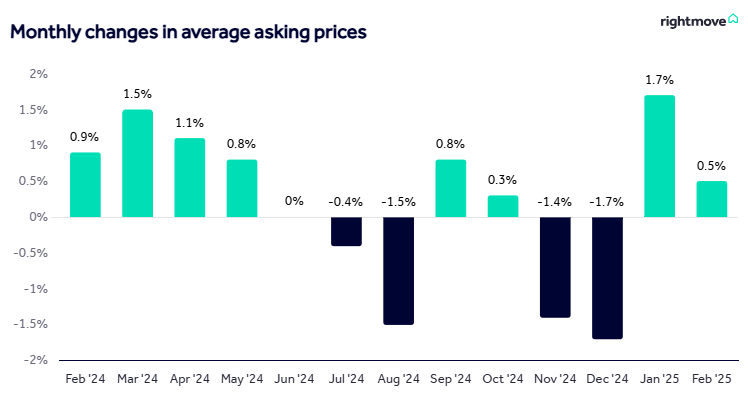

February’s house price index from property firm Rightmove has found that the average price of property coming to market for sale has risen by 0.5% in the month to £367,994, as sellers lower price expectations ahead of the stamp duty deadline.

Rightmove also forecasts a ‘conveyancing log-jam’, with the number of available homes for sale at a 10-year high, and more than 550,000 homes sold yet awaiting legal completion – a 25% increase on this time last year.

New sellers are showing some pricing restraint after a fast start to the year, being mindful of both the high level of seller competition, and in England also of the looming stamp duty deadline and extra costs for some buyers.

Agents report that some of the steam is coming out of new sellers’ price expectations to fit the changing market conditions, which is a sensible reaction to attract buyer interest, and it will also help to support activity levels.

Colleen Babcock, Property Expert, Rightmove

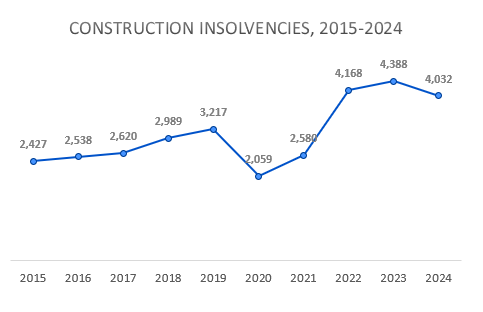

Construction insolvencies fall in 2024

The number of construction companies in England and Wales filing for insolvency in 2024 has fallen by -8% on the previous year, from 4,388 in 2023 to 4,032, according to data from the Insolvency Service.

In December 2024 the number of registered company insolvencies for the construction industry was 291, down -8% from November 2024 and -20% from December 2023.

However, the number of construction insolvencies in 2024 is still 25% higher than the 3,217 registered in 2019.