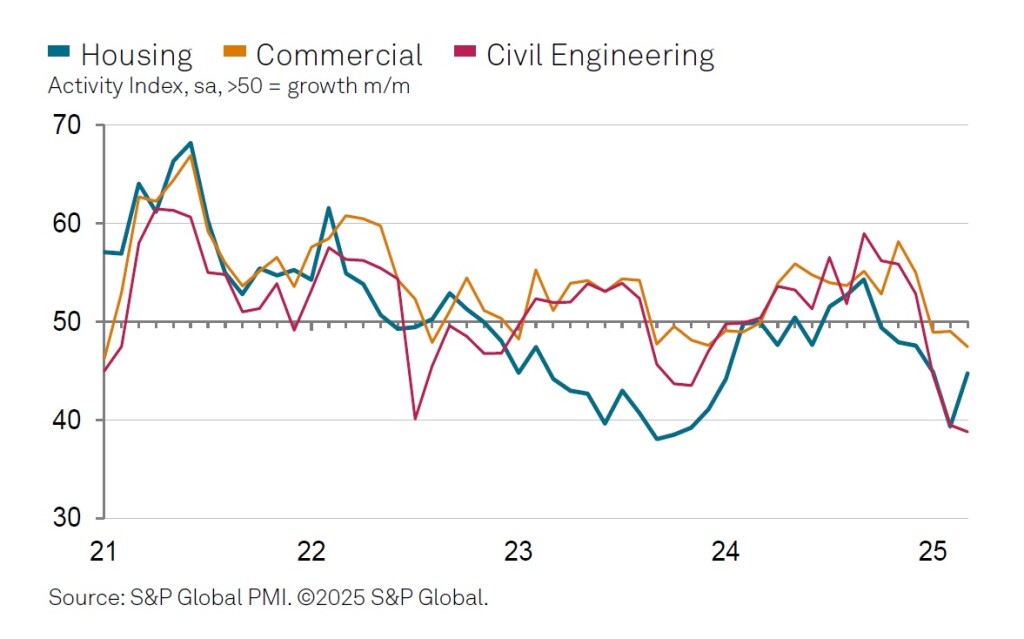

Bellweather survey shows improvement albeit output remains in decline

The headline S&P Global UK Construction Purchasing Managers’ Index registered 46.4 in March; an increase from 44.6 in February but still below the 50.0 threshold for an increase in output.

Residential building activity improved from 39.3 in February to 44.7 in March, with survey respondents suggesting that easing borrowing costs are helping to support confidence.

BNG remains a challenge for SME firms

A report from the Home Builders Federation has found that 98% of small and medium sized housebuilders find biodiversity net gain (BNG) a challenge.

The report, Biodiversity Net Gain: One year on, also found that 94% of respondents cited delays in processing planning applications due to BNG requirements, with 90% reporting delays to their developments “specifically due to insufficient BNG expertise or resources within local authorities”.

The report marks a year since mandatory BNG became a legal requirement for small developments, with developers achieving at least a 10% net gain in biodiversity.

In addition, 85% of housebuilders with small sites believe the costs of BNG are not proportionate to the size of their projects and 40% of local authorities lack access to in-house ecological expertise.

The home building industry has embraced BNG and is committed to both increasing housing supply and protecting and enhancing our natural environment.

However, if we are to increase supply alongside these new requirements it is vital to address emerging barriers to implementation, such as the insufficient resourcing of local authorities, shortage of ecologists, and inadequate national guidance.

Neil Jefferson, CEO, HBF

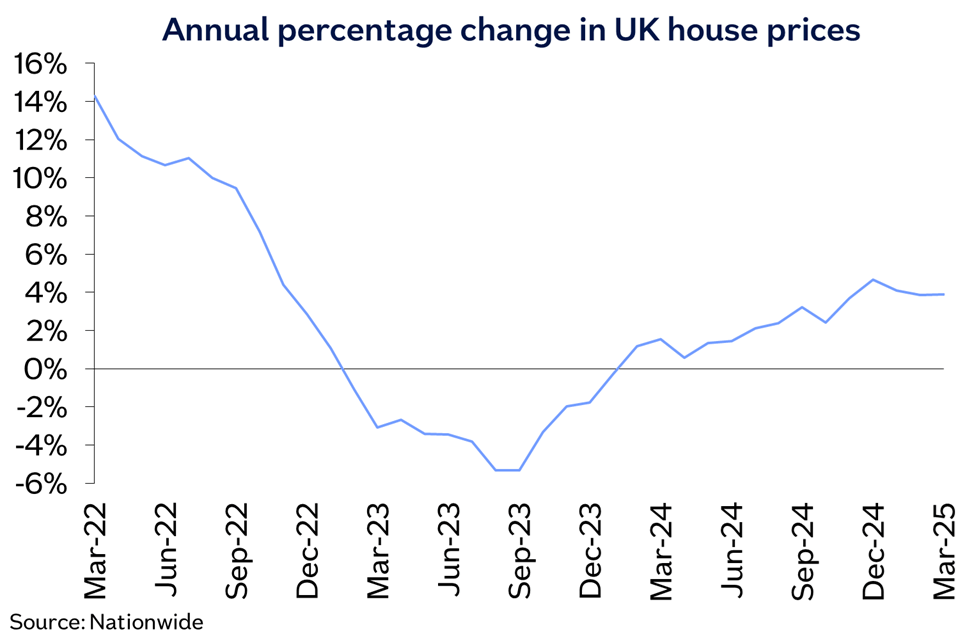

Annual house price growth remains steady in March

The latest house price index from Nationwide reflects on a stable housing market, with the annual rate of property value growth remaining at 3.9%, unchanged from February.

The average home is valued at £271,316, a marginal increase from February (£270,493).

The mortgage provider also revealed that semi-detached houses have seen the biggest percentage rise in prices over the past year, with average prices up by 4.8%.

Robert Gardner, Nationwide’s Chief Economist, said: “UK house price growth remained stable in March at 3.9%, the same as in February. There was no change in prices month-on-month, after taking account of seasonal effects. These price trends are unsurprising, given the end of the stamp duty holiday at the end of March (transactions associated with mortgage approvals made in March, especially toward the end of the month, would be unlikely to complete before the deadline).

“Indeed, the market is likely to remain a little soft in the coming months since activity will have been brought forward to avoid the additional tax obligations – a pattern typically observed in the wake of the end of stamp duty holidays.”

Labour costs continue to rise

Consultant Mace has revised its tender price forecast up for the year, due to rising labour costs.

Amidst construction vacancies which have risen to their highest level in 18 months, labour costs rose by 1.6% in the final quarter of 2024, marking a 6.5% annual increase.

Construction pay is now rising faster than in all but one other sector, and growing at its highest rate since coming out of the pandemic.

Construction pay growth also more than doubled from March to the end of the year.

Mace’s updated forecast has risen from 3.5% to 4% for 2025.

Network Rail to unlock housing land

Network Rail and the Government’s London & Continental Railways are set to start a development business with the potential to deliver 40,000 new homes over the next ten years.

Rachel Reeves has confirmed the first four sites under the new deal, with the company operational later this year.

The partnership will attract public and private investment to develop brownfield sites.

Travis Perkins profit slumps

Builders merchant Travis Perkins has declared a fall in profits to just £2m last year; a -99% slump with the firm’s pre-tax profit sinking to £77m loss from a £38m profit in 2023.

Revenue was also down -5% to £4.6bn.

The firm is searching for a new Chief Executive after Pete Redfern stepped down last month after just six months in the role, due to ill health.