MHCLG Chair issues letter to Rachel Reeves

The Chair of the Ministry of Housing, Communities and Local Government (MHCLG) has written to Chancellor Rachel Reeves, expressing concerns over recent media reports which suggest that the department could experience “significant cuts” to its budget in next week’s Spending Review.

Florence Eshalomi described the Review as “make or break for the 1.5 million homes target”, and highlighted that the last time the UK built over 300,000 homes in a year was in 1977.

Despite the cross-party consensus of the need to increase housebuilding, successive governments have for decades failed to deliver enough new homes.

This has resulted in and a housing affordability crisis, with families waiting years on social housing waiting lists and the dream of home ownership fading for many.

It is now imperative that the Government seizes the opportunity at the Spending Review to meet the scale of its housing ambition.

Florence Eshalomi, Chair, MHCLG

Meanwhile, the Government has confirmed that homes built under the forthcoming Future Homes Standard (FHS) will have solar panels “by default”, as it announced that the FHS will be published this autumn.

There will, however, be flexibility for new homes “surrounded by trees or with lots of shade overhead”.

The FHS will still require low carbon heating in new homes, and include high levels of energy efficiency, “cutting people’s energy bills and boosting the nation’s energy security with clean, homegrown power,” the Government said.

The Government also announced an investment into new housing for the armed forces, as part of its Strategic Defence Review.

The Ministry of Defence has announced the development of new forces housing, as part of its plan to unlock housing development on surplus Ministry of Defence land.

The Defence Review adds an additional £1.5bn for armed forces housing.

Planning permissions for homes slump to new low

The number of new homes given planning approval in England during Q1 2025 was 39,170 – the lowest number of quarterly approvals since 2012 and the third lowest since the data set was started in 2006; a 55% drop on the previous quarter and 32% drop on Q1 2024.

The figures are included in the latest Housing Pipeline report form the Home Builders Federation (HBF) based on data from Glenigan.

The rolling annual number of units approved in the year to Q1 2025 was just 225,067, a 7% drop on the previous 12 month period and the lowest 12-monthly outturn recorded since 2013. The figure is just 61% of the 370,000 number the Government has cited as an ambition to achieve, through cumulative local authority housing targets across the country.

The latest planning figures are disastrous for an industry and a Government looking to increase housing supply over the coming years.

With current supply flatlining and permissions for homes to be built over the next few years plummeting, unless urgent interventions are made, there seems little chance of us building the homes we know are desperately needed.

Neil Jefferson, Chief Executive, HBF

Section 106 timescales increase by 20% in two years

New research by the Home Builders Federation has revealed that housing developers are now waiting an average of 515 days for Section 106 infrastructure agreements to be finalised.

The delay represents a 20% increase over two years, from 425 days in 2022/23. The longest recorded timescale reached as high as seven years.

The HBF recommends increasing planning resource, developing national standard templates and introducing statutory timelines for Section 106 agreements.

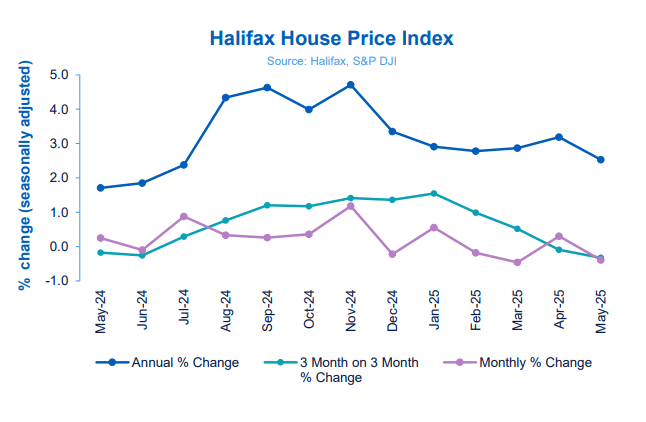

Halifax and Nationwide house price indices published

The Halifax house price index for May has found that the average property value fell by -0.4% in the month, with annual rate of growth slowing from 3.2% in April to 2.5%.

The average property price is now £296,648 (Apr: £297,798).

Northern Ireland once again recorded the fastest pace of annual property price inflation, up by 8.6% over the past year. Wales and Scotland also posted annual growth of 4.8% in May.

The outlook will depend on the pace of cuts to interest rates, as well as the strength of future income growth and broader inflation trends. Despite ongoing pressure on household finances and a still-uncertain economic backdrop, the housing market has shown resilience – a story we expect to continue in the months ahead.

Amanda Bryden, Head of Mortgages, Halifax

Meanwhile, Nationwide reported a 0.5% increase in house prices in May, with annual growth also increasing slightly from 3.4% in April to 3.5%.

The average property is valued at £273,427 (Apr: £270,752).

The mortgage lender also identified that average house price growth in rural locations has continued to outpace more urban areas, at 23% against 18% respectively between December 2019 and December 2024.

Both indices highlighted the ongoing affordability crisis; a challenge reinforced by research this week from banking trade body UK Finance.

The firm found that first-time buyers are borrowing through mortgages that last an average of 31 years; an increase of three years from the average mortgage term a decade ago.

Higher mortgage rates have pushed people to borrow for longer, to keep their monthly repayments as low as possible.

Construction activity decline slows

The latest S&P Global UK Construction Purchasing Manager’s Index has found that construction activity continues to remain in decline, but that the pace is slower than the last four months.

The index posted 47.9 in May, up from 46.6 in April, with any score below 50 indicating negative growth.

Housebuilding was the weakest performing segment in May, at 45.1, with the downturn in residential construction work accelerating since April.

Gleeson warns of profit drop

Housebuilder Gleeson Homes has warned that its operating profit for the year ending 30 June 2025 will be around 15% to 20% lower than current expectations.

In a trading statement this week, the developer said that its margin would be 1% lower than expected due to “a number of headwinds”, including “increased build costs, flat selling prices, the continued use of incentives and several bulk sale transactions”.