Scheme set to deliver more than 500,000 new homes

The Government has launched a National Housing Bank to speed up housebuilding, and deliver more than half a million new homes.

The bank will be publicly owned as a subsidiary of Homes England, and will leverage £53bn of additional private investment, according to the Ministry of Housing Communities and Local Government (MHCLG).

The bank will also be backed with £16bn of financial capacity on top of £6bn of existing finance.

We‘re turning the tide on the housing crisis we inherited – whether that’s fixing our broken planning system, investing £39 billion to deliver more social and affordable homes, or now creating a National Housing Bank to lever in vital investment.

Angela Rayner, Deputy Prime Minister and Housing Secretary

The scheme builds on £39bn investment announced at the Spending Review for a new ten-year Affordable Homes Programme – which could help deliver another 500,000 homes over a decade “at a stretch”, according to JLL.

Nick Whitten, EMEA Head of Living Research at JLL, said: “A £39bn pledge for new affordable housing over the next decade is the largest government commitment we’ve seen in half a century – and one that has to be commended at a time when the public purse is more than a little stretched.

“But while the ambition is clear, the reality is complex. If used as part of a typical grant funding model and spread appropriately across tenures, this sum could support delivery of up to 500,000 affordable homes over the next decade. However, that still leaves a significant shortfall against the national target.”

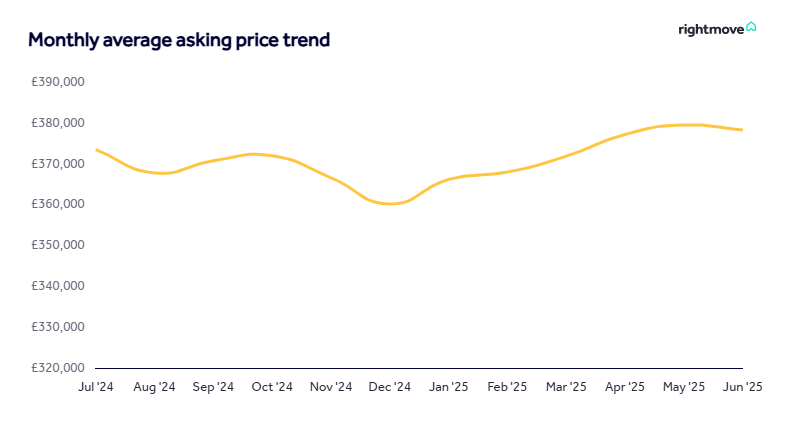

Asking prices fall by -0.3% in June

Rightmove has published its latest house price index for June, revealing that asking prices have fallen by -0.3% in the month to £378,240.

This is an unusual dip for June, as new sellers lower their price expectations amid decade-high competition to secure buyers.

Buyer activity continues to be resilient, with May seeing the highest number of sales agreed in any month since March 2022.

Meanwhile, the Office for National Statistics house price index for April shows a -2.7% fall in monthly house prices, with annual property values rising by 3.5% to £265,000.

The East Midlands enjoyed the highest annual change of all English regions, at 3.8%. The South West region experienced the lowest annual change, at 0.9%.

In other news…

Rob Perrins, Chief Executive of the Berkeley Group, is to become Executive Chair of the board in September. Richard Stearn, Finance Director since 2015, will become Chief Executive when Perrins moves up.

–

Timber and panel import volumes reached 2.26 million cubic metres in Q1 2025, according to Timber Development UK figures.

The figure represents a 0.6% year-on-year growth was the first increase seen since 2021.