Further information provided following Spending Review

The Government plans to deliver around 300,000 new homes under its Social and Affordable Home Programming, with at least 60% earmarked for social rent.

Following its £39bn announcement in the Spending Review, the Ministry of Housing, Communities and Local Government (MHCLG) noted that it would be spending almost double on affordable housing investment by the end of this parliament, when compared to the 2021-26 Affordable Homes Programme.

We are seizing this golden opportunity with both hands to transform this country by building the social and affordable homes we need, so we create a brighter future where families aren’t trapped in temporary accommodation and young people are no longer locked out of a secure home.

Angela Rayner, Deputy Prime Minister and Housing Secretary

Matthew Pennycook also announced this week that newly-built council homes will be exempt from Right to Buy for 35 years.

The Housing Minister confirmed further reforms to the policy “to protect much-needed social housing stock”.

Pennycook said the government will also increase the length of time someone needs to have been a tenant to qualify for Right to Buy from three to 10 years.

Meanwhile, the MHCLG confirmed that it is to take on the functions of the Building Safety Regulator, which has struggled recently when overseeing the approval of high-rise residential buildings.

The move is part of “initial steps towards creating a single construction regulator” as recommended by the Grenfell Tower inquiry.

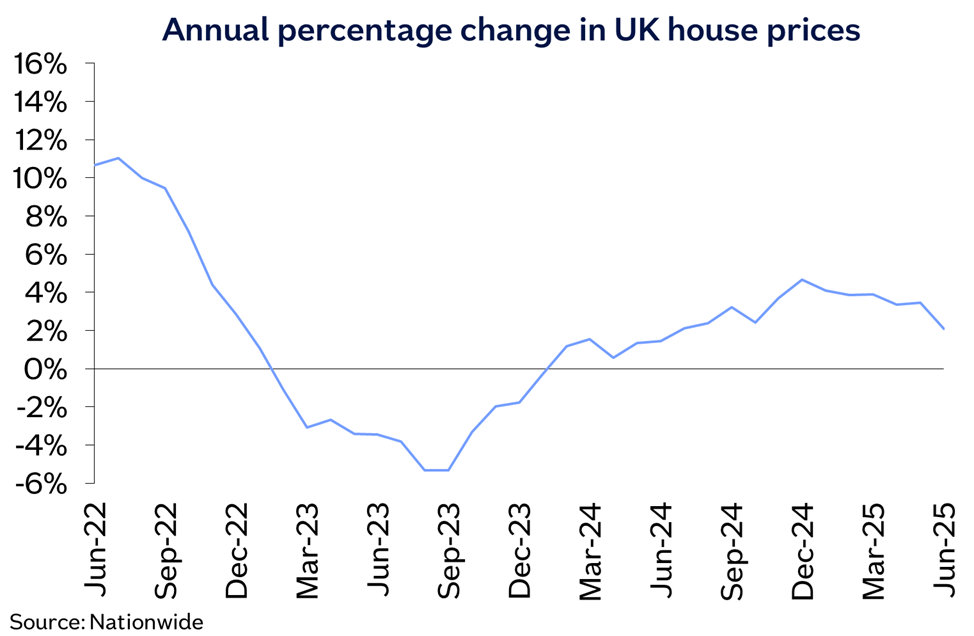

Annual house price growth softens in June

Nationwide has published its house price index for June, revealing a 2.1% annual increase – a fall from 3.5% annual growth in May.

The fall also translated into a -0.8% monthly change, with the average UK property value slipping to £271,619 from £273,427.

Northern Ireland remained the top performing area, with annual house price growth of 9.7%. East Anglia was the weakest performer with annual growth of 1.1%.

Meanwhile, Zoopla’s house price index for May reveals a 1.4% increase over the year, with the average property valued at £268,400.

The number of sales being agreed continues to run at the fastest rate for four years, but is beginning to steady as the summer slowdown begins.

The average time to sell is 45 days, in line with June 2024.

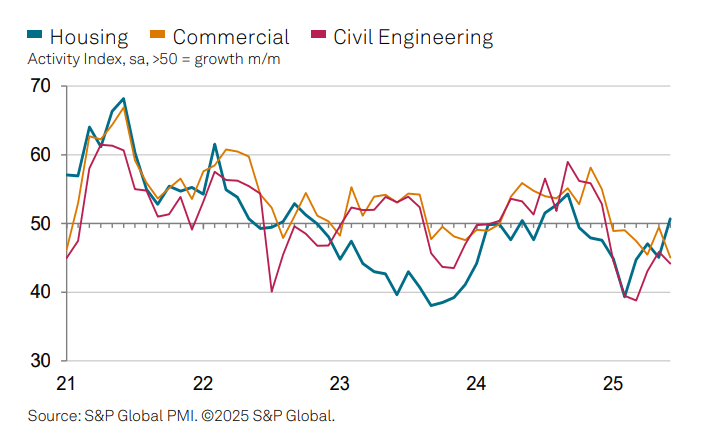

Housebuilding returns to growth

The S&P Global UK Construction Purchasing Managers Index hit 48.8 in June, up from 47.9 in May, but still below the 50.0 no-change score.

However, housebuilding edged back into growth with a score of 50.7, jumping from the 45.1 value registered in May.

Kelly Boorman, national head of construction at restructuring firm RSM, said the rise “implies that recent government announcements to remove red tape and unlock new homes are finally mobilising projects despite market uncertainty around house prices and planning delays”.

HBF assesses Labour’s first year in office

The Home Builders Federation has published an assessment of Labour’s first year in power, noting that housing delivery continues to fall and is “well short” of what is needed to achieve the target of 1.5 million new homes.

One Year On: Progress Report on Housing Delivery Since the General Election finds that the optimism of early planning reforms are outweighed by ongoing policy and delivery challenges, which remain largely unaddressed and are “now seriously constraining the sector’s ability to increase supply”.

HBF’s publication “scorecards” the government in six policy areas: national planning policy; the planning process; affordable housing; solutions for nutrient and water neutrality; expanding the workforce and emerging issues impacting the industry.

Meanwhile, the CITB has published its Labour Market Intelligence Report 2025-2029, which predicts modest signs of growth in the construction industry, with 2.3% in 2026, 2.4% in 2027 and 2.3% in 2028.

The report also finds that building firms will need to recruit 239,300 workers to meet the Government’s housing target; but 54% of employers say the sector has not got the workforce it needs, and 76% admit they struggle to recruit skilled people.

In other news…

Mark Knight has left his position as Chief Executive of Gleeson Homes, following ongoing delivery issues and gross margin pressures. Simon Topliss, previously Gleeson Homes’ Finance Director, has now been appointed to the new role of Chief Operating Officer.

–

Hill Group has achieved record turnover and profit for the second consecutive year, reporting revenues of £1,151.9m and pre-tax profit of £90.5m for the year ending 31 March 2025.

This compares to last year’s revenue of £1,145.9 million and a pre-tax profit of £70.1 million, for the 15 months ending March 31 2024.