NHBC data reveals 6% year-on-year rise in private sector

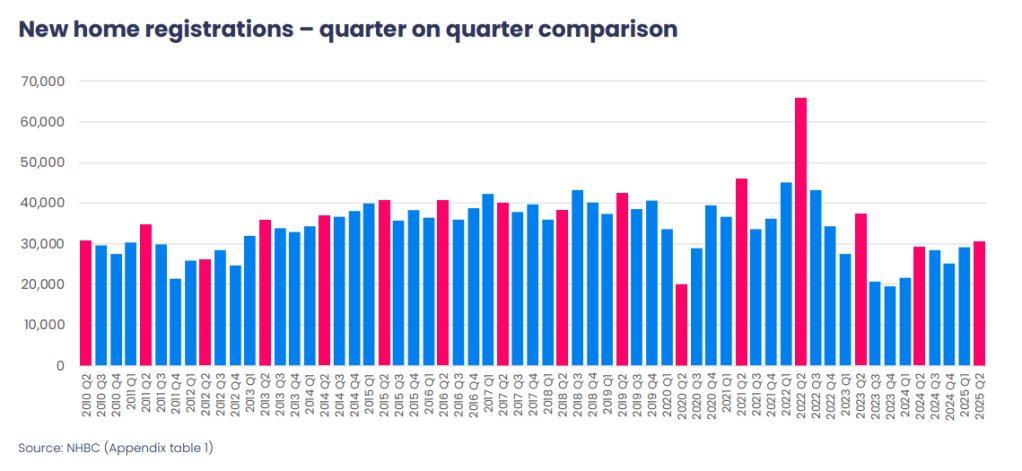

Latest new home registration figures from the NHBC have demonstrated “modest” growth in the second quarter of 2025, with registrations for the private sector rising by 6% compared to the same period last year.

Whilst private sector registrations rose to 20,924 in Q2 2025 (Q2 2024: 19,728), rental and affordable sector registrations saw just a 1% rise to 9,481 new homes.

Total UK home registrations rose 4% against Q2 2024 to 30,405 new homes; a 4% increase from Q1 2025.

Meanwhile, NHBC recorded 32,434 completions, a -5% fall on the same period in 2024.

Research by the BBC has found that the number of new homes in England fell during Labour’s first year in office, but applications to build more rose over the past six months.

Just over 200,000 homes got their first Energy Performance Certificate in the 12 months to June 2025, down -8% from the year before.

However, Planning Portal figures showed permission requests for new homes outside London between January and June were 49% up on last year.

NHBC figures have shown a -59% slump in new home registrations in London, as developers and housing associations tackle challenges linked, in part, to the Building Safety Regulator.

Profit warnings among construction companies hit post-pandemic peak

Companies listed in the UK’s FTSE Construction and Materials sector issued eight profit warnings in the first half of 2025, up from just two during the same period in 2024.

According to EY-Parthenon’s latest Profit Warnings report, this marks the highest number of warnings since the COVID-19 pandemic in 2020.

Previous gains are being eroded by the return of cost and demand challenges, which are exposing persistent structural weaknesses. Whilst longer-term supply and demand dynamics should support growth in the sector, there are a number of nearer-term challenges that are impacting contractors and the supply chain.

Regulatory complexity, particularly from the Building Safety Act, continues to slow approvals and disrupt delivery, while labour shortages and the increase in employer national insurance contributions are also squeezing margins. Access to bonding and trade credit insurance has been tightening and the sector remains susceptible to shocks. A drop off in demand may ease some of these pressures, but this tends to help main contractors more than subcontractors and suppliers, where financial stress has been concentrated.

Tim Vance, Partner, EY-Parthenon UK & Ireland

However, retentions could be prohibited under new government proposals aimed at tackling late payments.

Among a range of legislative measures intended to support small and medium-sized businesses are “options to reform or ban cash retentions in construction contracts.”

Construction growth forecast remains unchanged

The Construction Products Association (CPA) is maintaining the spring forecasts it released in April, projecting construction output growth of 1.9% in 2025 and 3.7% in 2026.

However, ongoing planning delays and the possibility of tax increases have introduced more uncertainty than usual around these projections.

“The key fundamentals for the construction industry remain largely unchanged. Although everything continues to point towards a steady pickup in construction activity through the rest of this year and into 2026, the only thing that has changed is the uncertainty,” said Rebecca Larkin, the CPA’s head of construction research.

Growth over the next two years is expected to be led by the industry’s three largest sectors: private housing new build, private housing repair, maintenance and improvement, and infrastructure. Still, these areas face near-term challenges, including delays in project starts, consumer and homeowner confidence, and the growing likelihood that the government may need to raise taxes, reduce capital spending, or both.

Private housing is projected to rise by 4% in 2025 and 7% in 2026; but, according to the CPA, smaller developers will continue to experience site viability challenges.

And, according to a report from insurer QBE, in partnership with global risk consultancy Control Risks, contractors should brace themselves for material increases.

Recent international tariffs are, the report says, pushing up costs on key materials such as steel, aluminium and timber.

The report also highlights copper prices surging 29% in early 2025, fuelled by trade barriers and global demand from renewable energy and electric vehicle projects.

Annual house price growth edges up in July

The latest house price index from mortgage lender Nationwide has revealed that annual property price growth has increased form 2.1% in June to 2.4% in July.

Monthly growth also crept up by 0.6%, with the average property valued at £272,664.

Meanwhile, Rightmove have reported a -1.2% fall in house prices in the month, with the average price of property falling by £4,531 to £373,709.

As such the firm is reducing its price forecast for 2025 from 4% to 2%, as the high level of seller competition is limiting price growth, and retaining its prediction of 1.15 million transactions this year.

Developer and supply chain updates

Taylor Wimpey completed 5,264 homes in the first half of the year, an 11% increase from 4,728 in the same period last year. However, the company reported a loss for the period, driven by £222.2m in new cladding fire safety provisions.

Operating profit dropped -12% to £161m, largely due to a £20m charge related to the collapse of a contractor responsible for remedial work on a former Taylor Wimpey site.

A significant portion of the new cladding provision stems from the identification of cavity barrier issues that only became apparent once brickwork and render were removed – problems not detected in earlier non-intrusive assessments. Combined with other charges, including an £18m provision linked to the CMA agreement, the company posted a pre-tax loss of £92.1m.

Lovell Partnerships saw growth in both revenue and operating profit during the first half of the year, despite what parent company Morgan Sindall described as a “slow pace” of recovery in the housing market.

In the six months to 30 June 2025, the division delivered a 13% increase in operating profit compared to the same period in 2024, reaching £13.2m. Revenue rose by 6% to £405m, while operating margin improved by 20 basis points to 3.3%.

Lovell, which partners with housing associations and local authorities as both contractor and developer, reported continued “robust” demand, with projects secured via frameworks or direct negotiation. Contracting activity saw a 16% increase in equivalent units built, totalling 1,838.

However, mixed-tenure completions declined. Open market sales fell -10% to 327, with total mixed-tenure completions dropping to 625 from 784 the previous year. The average selling price of homes rose from £222,000 to £254,000.

Meanwhile, Berkeley Group has teamed up with the Supply Chain Sustainability School to launch a new initiative aimed at equipping the construction industry with the skills needed to achieve the UK’s net zero targets.

The Net Zero Skills in Construction Programme will provide tailored training, resources, and support to build practical expertise, raise awareness, and unlock new business opportunities in sustainable construction, the housebuilder said.

Running for two years and delivered through the Supply Chain Sustainability School’s free training model, the programme will focus on helping SMEs and education providers “confidently adopt net-zero approaches.”

Supported by the Construction Industry Training Board’s (CITB) Industry Impact Fund, the initiative has been developed in collaboration with major industry players including Kier, Balfour Beatty, Morgan Sindall, and other members of the School’s Future Workforce Leadership Group.

Brickmaker Forterra expects full-year profit to exceed previous forecasts, after stronger-than-anticipated demand from the housebuilding sector lifted its interim performance.

In the five months to the end of May, brick dispatches rose 14% compared to the same period last year. Turnover for the six months to June increased by 20% to £195m.

“The Board is encouraged by the Group’s H1 performance, with demand for most products ahead of both the prior year and the Board’s previous expectations,” the company said.

However, in a trading update for the six months to 30 June 2025, Marshalls said it does not expect any improvement in market activity levels for the remainder of the year.

As a result, the board has lowered its full-year outlook, now forecasting adjusted profit before tax to be between £42m and £46m for 2025.

While revenue from landscaping products, such as paving blocks, declined by -1% year-on-year to £135m (2024: £137m), total revenue for the first half of the year was up overall.

In other news…

Sir James Cleverly was appointed Shadow Housing Secretary in a reshuffle by Conservative Party leader Kemi Badenoch last week.

He replaces Kevin Hollinrake, who is the new Conservative Party chairman.