Government responds to New Towns Taskforce report

The Ministry of Housing, Communities and Local Government (MHCLG) has announced that the Government will begin building at least three new towns in this parliament.

MHCLG said that the three sites – in Tempsford, Crews Hill and Leeds South Bank – looked “the most promising” for progression, in its response to the New Towns Taskforce’s report.

Housing Secretary Steve Reed announced the plans at the Labour Party Conference this week, saying: “We know that national renewal depends on the renewal of every town, village and community that makes up our great country.

“We’ll build the homes people need. We’ll build the communities where they can thrive. We’ll bring in the investment and the jobs that will open up opportunities.”

Industry leaders have largely welcomed the announcement, as reported in Housebuilder.

MHCLG brands Section 106 crisis as “not good enough”

Analysis by the Home Builders Federation (HBF) has revealed that more than 700 housing developments are estimated to have stalled – putting 8,500 affordable homes due to be built at risk – due to social housing providers failing to take them on.

The report also found that around 900 completed affordable homes stand empty, with registered providers – embattled by economic and policy challenges – unable to commit to purchasing them from developers under Section 106 agreements.

Neil Jefferson, Chief Executive at the Home Builders Federation, said: “Against rising affordability pressures and increasing numbers of families living in temporary accommodation, it cannot be that Affordable Homes are left standing empty.

“Government’s social and Affordable Housing announcements were a welcome step to giving Registered Providers confidence to plan long term, but they are doing little to ease the immediate constraints of delivering Affordable Housing through Section 106 agreements.”

MHCLG responded to the report by stating that it was “not good enough”, and criticised registered providers for not buying enough Section 106 affordable homes.

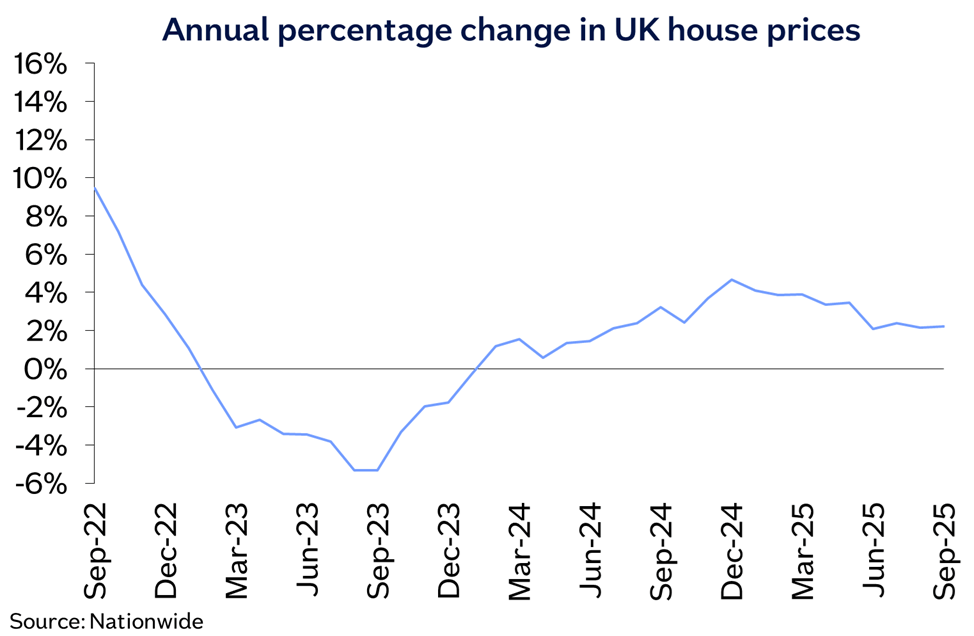

House price growth steady in September

Latest house price analysis by Nationwide has revealed a 0.5% increase in property values in September, bringing the average UK house price to £271,995.

Annual rate of house price growth also remained stable at 2.2% (Aug: 2.1%).

Most regions saw a modest slowdown in annual house price growth in the third quarter of 2025, although Northern Ireland continued to remain the strongest performer by a wide margin.

Average prices in Northern England were up 3.4% year on year, but average house price growth in Southern England slowed to 0.7%.

Meanwhile, Zoopla’s house price index for August paints a similar story, with annual house prices remaining stable at 1.4%, or £3,870 over the past year.

However, the firm noted that pre-Budget tax speculation was hitting activity for higher-value homes, with demand down by -11% over the past five weeks for homes priced at £1m or more.

Value of site starts falls by -16%

The latest Construction Index from market data collector Glenigan has revealed a -16% decline in projects valued at under £100m in the three months to September 2025.

The value of residential starts in the quarter was down -26% on the preceding three months, and by -24% on the year.

Allan Wilen, Economic Director for Glenigan, said: “Looking at the residential market, project starts have faltered over the past quarter, which, perhaps, reflects the slower-than-anticipated recovery in house purchaser confidence, coupled with ongoing developmental delays. This is in part due to slow BSR (Building Safety Regulator) approvals, which account for the sharp fall we registered in the apartment sub-vertical.”

Developer and supply chain updates

Taylor Wimpey has reported a “robust” performance in the face of subdued market conditions, with sales rates softening only slightly compared with last year. In its latest trading update, the housebuilder said it remains on course to deliver between 10,400 and 10,800 UK home completions in 2025, despite a more challenging backdrop.

From late July to the end of September, its net private sales rate averaged 0.65 per outlet per week, down modestly from 0.70 in the same period last year. Excluding bulk deals, the rate was 0.64, compared with 0.68 previously.