Announcement comes as Badenoch launches conference pledge

The Ministry of Housing, Communities and Local Government (MHCLG) have this week announced “the biggest shakeup to the home buying system in this country’s history”, following a consultation on the property purchasing process launched in February.

The Government said that its proposal – which requires sellers and estate agents to provide buyers with “vital information” about a property from day one, and binding contracts to help halve the number of failing transactions – was set to save first-time buyers £710 on average.

MHCLG is also proposing introducing mandatory qualifications and a Code of Practice for estate, letting and managing agents.

Meanwhile, the Conservative leader Kemi Badenoch announced that her party would abolish stamp duty if they gained power.

Speaking at the Conservative party conference, Badenoch said that the tax would be removed on primary residences.

SME builders face mounting challenges

Small and medium developers are facing stalled delivery on smaller sites and an ever-increasing amount of planning barriers, a new report form the Home Builders Federation (HBF) says.

The report, Planning for Small Sites, published in conjunction with Quantum Development Finance, found that:

- The average time from planning application submission to committee decision is 30 weeks;

- 13% of sites take more than two years to achieve permission;

- Small sites face average planning fees and obligations of approximately £7m per site.

The report also noted increased costs as a result of the Building Safety Levy, Biodiversity Net Gain, and the threat of landfill tax changes.

Neil Jefferson, HBF Chief Executive: “With a large proportion of the homes that SMEs build falling within the small site category, the findings from this report show that as a group they are in real danger of not just being unable to deliver homes but being unable to stay in business.

“While government wants to assist SMEs, the barriers our members are facing is substantial, and needs intervention to reverse the trends of declining small site approvals we are seeing.”

Jefferson also spoke this week at the Housing Market Intelligence Conference in London, where he urged the Government for “changes now” to help the industry deliver more homes, as reported in Housebuilder.

Costs are also set to rise, with the Building Cost Information Service (BCIS) predicting a 15% increase over the next five years.

The BCIS also says that tender prices will rise by 16% over the same period (to autumn 2030), but that new work output will grow by 18%.

Demand is broadly flat and inflation is sticky, leaving a stagflation-type squeeze: weak growth on one side, elevated labour and materials on the other and margins under pressure.

We therefore expect only a modest uptick in output in Q4 2025.

David Crosthwaite, Chief Economist, BCIS

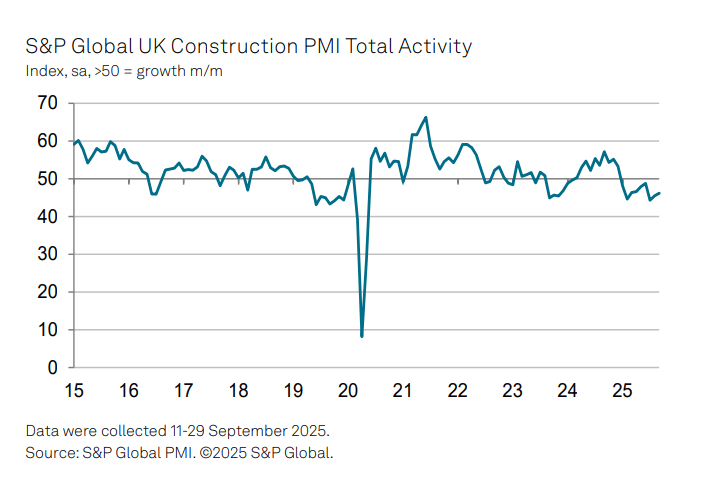

Meanwhile, the monthly survey of construction purchasing managers has found that industry activity has shrunk again in September – the ninth consecutive month of decline.

The S&P Global Purchasing Managers Index reading for September 2025 was 46.2; up from August’s 45.5 score, but still below the 50.0 threshold for an increase in construction output.

Residential work scored 46.8, with respondents noting a lack of new project starts due to subdued demand, elevated business uncertainty and general hesitancy among clients.

Similarly, the latest UK Residential Market Survey from the Royal Institution of Chartered Surveyors (RICS) has found that the housing market is continuing to weaken, with no signs of a turnaround expected until next year.

The survey also found that buyer demand and agreed sales remain in negative territory for the third consecutive month, with many surveyors citing concerns over the upcoming November Budget.

House prices edge down in September

Halifax has published its house price index for September, revealing a -0.3% decrease in property values in the month.

The average UK home is now valued at £298,184, with the annual growth of rate also easing from 2.0% in August to 1.3% in September.

Northern Ireland once again led the fastest annual property price inflation, with values up 6.5% over the past year. Scotland recorded 4.5%, with Wales at 1.9%.

In England, the North East recorded the strongest annual growth at 4.8%, with the South West seeing a second consecutive house price fall, with prices down by -0.2% over the year.

Developer and supply chain updates

Building material manufacturer Ibstock has warned that profits this year will be below previous expectations, citing a more uncertain near-term economic and political backdrop leading to weaker than expected demand.

Full-year adjusted profit before tax is now likely to be £72m, down from the previously-announced range of £77m to £82m.