HBF publishes latest key report

Small and medium-sized developers could increase homes delivery by 56% if blockers to building were removed, according to a report by the Home Builders Federation.

The latest State of Play report, produced in conjunction with Close Brothers Property Finance and Travis Perkins, reveals that lifting these barriers to build could unlock 100,000 new homes a year.

The report, now in its sixth iteration, found that:

- 97% say business taxation and the regulatory environment are barriers to the growth of their business in the next 12 months.

- Financial pressures were a big barrier, with 64% citing cumulative viability pressures and 58% citing difficulties obtaining offers for S106 Affordable Homes.

- Regulatory and political challenges remain significant barriers; 66% report local or political opposition, 55% Biodiversity Net Gain and 54% the Building Safety Levy.

- 94% of SME builders cite securing planning permission or discharging conditions as a major issue.

- 89% of SME builders view Local Authority capacity as a major constraint

- Land and infrastructure issues also continue to limit delivery, with 54% citing land prices, 39% citing land availability, and 49% the costs/timescales for utilities provision.

- Construction and supply challenges are notable but viewed to have less impact with 43% citing labour/supply costs and 41% cost of materials as major barriers to growth. While 67% of respondents said the supply chain and materials availability were a barrier to growth, only 10% said it was a major barrier.

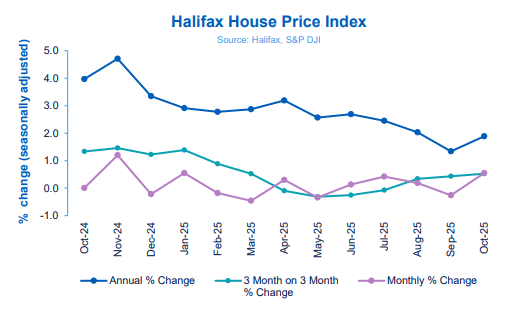

UK house prices rise at fastest pace since January

House prices in the UK rose by 0.6% in October, after a fall of -0.3% in September, according to the Halifax – the fourth time in the last five months that the average price has increased.

The average property price is now £299,862, with the annual rate of growth also rising from 1.3% in September to 1.9% in October.

Northern Ireland continues to post the strongest rate of annual property price inflation, with average values up 8.0% over the past year.

Scotland recorded annual price growth of 4.4%, with Wales experiencing a rise of 2.0%.

In England, the North East recorded the highest annual growth rate, at 4.1%, with London and the South East seeing prices fall in October by -0.3% and -0.1% respectively.

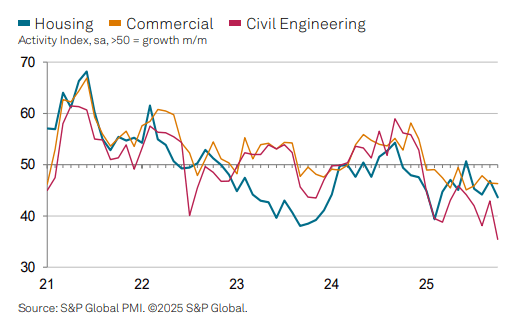

Construction activity reports fastest decline in five years

The latest S&P Global UK Construction Purchasing Managers’ Index has registered 44.1 in October, down from 46.2 in September and below the 50.0 no-change mark for the tenth consecutive month.

The fall marks the longest period of decline since the global financial crisis, and October saw the fastest fall in five years.

Civil engineering led the drop, with residential work also decreasing to 43.6.

Reduced workloads were again widely attributed to risk aversion and delayed decision-making among clients, which contributed to a slower-than-expected release of new projects.

Subdued demand in the wake of heightened political and economic uncertainty also led to the steepest drop in input buying since May 2020.

Tim Moore, Economics Director, S&P Global

Meanwhile, the latest UK Construction Monitor from the Royal Institution of Chartered Surveyors (RICS) reveals a headline construction workload indicator falling to -8%.

New project workloads declined noticeably as economic uncertainty, regulatory challenges and planning delays were all cited as reasons for the dip in construction activity.

Survey respondents did, however, expect a modest improvement over the next year.

However, expectations for business profit margins fell further into negative territory (-19%), reflecting regulatory and cost pressures.

This was also reflected in EY-Parthenon’s latest Profit Warnings report, which found that profit warnings from UK-listed construction companies in the third quarter of 2025 was at the equal highest level since the pandemic.

There were six profit warnings in the period from UK-listed companies in the FTSE Construction and Materials sector, bringing the total number of profit warnings so far this year to 14.

CMA accepts commitments from developers

The Competition and Markets Authority (CMA) has accepted commitments from seven of the UK’s biggest developers, following its probe into suspected anti-competitive behaviour.

The housebuilders – Barratt Redrow, Bellway, Berkeley Group, Bloor Homes, Persimmon, Taylor Wimpey and Vistry – agreed to pay £100m to affordable housing programmes in July, in response to the CMA’s investigation into whether the developers exchanged details about sales.

The commitments see the housebuilders agreeing not to share certain types of information, and working with the Home Builders Federation and Homes for Scotland to develop industry guidance on information sharing.

The CMA’s acceptance of the commitments brings the investigation to an end, “with no decision being made as to whether the Competition Act 1998 has been infringed”, the CMA stated.

Government announces Defence Housing Service

The Ministry of Defence (MoD) has announced a new Defence Housing Service to deliver and refurbish homes for military personnel.

The new government arm will see £9bn invested over the next decade, and follows Labour’s announcement in June on investment into new housing for the armed forces.

Developer and supply chain updates

Vistry said it remains on track to meet full-year expectations, with partner-focused delivery continuing to drive stable demand and improved conversion through the autumn selling season.

The group reported an 11 % rise in private sales rates since 1 July (0.81 vs 0.73) and confirmed a forward order book of £4.3 bn, giving management visibility into 2025.

–

Barratt Redrow reported a solid start to FY 2026 with completions up 7.9% year-on-year to 3,665 and a forward order book of £3,281.4m, while reiterating full-year completions guidance of 17,200–17,800 homes.

The group said reservation rates remain broadly stable and synergy extraction from the Redrow merger continues at pace, but warned that the trajectory for the remainder of the year will hinge on Budget-driven demand and typical seasonal patterns.

–

UK sales of ready-mixed concrete fell by 12% year-on-year in the third quarter, with volumes down 0.8% compared to the previous quarter, according to data from the Mineral Products Association.

The decline is most acute in London, where volumes plunged by 32% as housing and infrastructure activity stalled and planning delays bite.