Rightmove’s latest house price index reveals monthly fall

Rightmove has published its house price index for November, revealing a -1.8% fall in asking prices in the month.

The property website noted that this was a “larger-than-usual” November drop, as the decade-high number of new homes for sale and Budget hiatus adds to the seasonal slowdown.

The firm also noted that speculation around the upcoming Budget is “fuelling uncertainty across much of the market”, especially at the upper end of property values.

Rumours of the contents of the forthcoming Budget are affecting the market, as we’re seeing a greater hesitation in sales activity, especially at the upper end, which has been the focus of most of the discussion.

While there is also a general unease at how the Budget may impact personal finances, the majority of home moves would be unaffected by the rumoured changes to property taxes.

Colleen Babcock, Property Expert, Rightmove

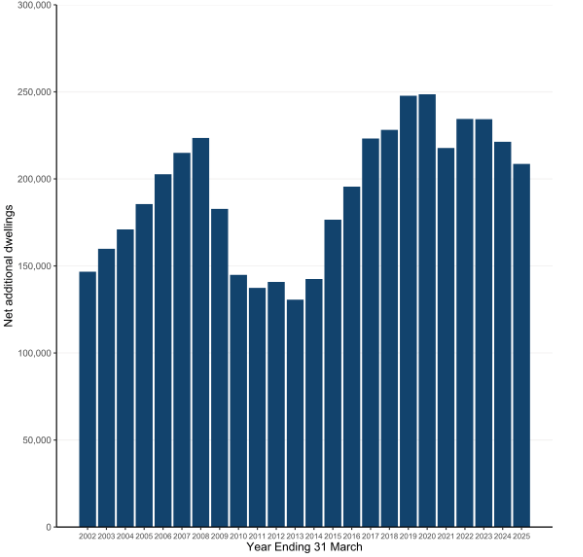

New dwellings in 2024/25 fall against previous year

Latest Government statistics have revealed that there was a total of 208,600 net additional dwellings in 2024/25 – a -6% decrease on 2023/24.

Of these, 190,600 were new homes built in England over the period from April 2024 to March 2025.

David Crosthwaite, Chief Economist at the Building Cost Information Service, said: “The latest figures underline the scale of the challenge facing the government. With net additions falling for the third consecutive year, delivery is moving further away from where it needs to be.

“On the current trajectory, we are looking at something closer to 1 million homes over the parliament, rather than the 1.5 million that has been promised.”

Meanwhile, Housing Secretary Steve Reed confirmed this week that new homes near train stations would receive planning permission by default, as part of further revisions to the National Planning Policy Framework.

This default will also apply to green belt land, with the Ministry of Housing, Communities and Local Government “recognising the significant benefits for jobs and growth that can be unlocked by building around train stations”.

However, the National Federation of Builders (NFB) have warned that the Government’s proposed changes to Landfill Tax would not only make some construction projects unviable, but would also be ineffective in driving waste away from landfill sites.

The NFB’s report – Going Full Circle – makes eight recommendations, including rewarding recycling and reuse, tackling waste crime offenders and increasing landfill capacity.

Help to Buy delivered a £1.38bn return

The Home Builders Federation (HBF) has found that Help to Buy has delivered a £1.38bn return on investment for taxpayers.

The homeownership scheme, which was introduced in 2013, produced a profit of £1.2m per day last year, having supported over 387,000 households into homeownership.

Using Government data, the HBF found that across 181,437 fully repaid loans, Government had received a 10.3% uplift on the original loan value, amounting to £1.02 billion in positive returns. This is in addition to a further £358 million generated from interest payments.

Nature is “not a blocker” to housing development

A report by the House of Commons’ Environmental Audit Committee has concluded that nature is not a “blocker” to building new housing, but a necessity for delivering resilient neighbourhoods.

The report, Environmental sustainability and housing growth, took aim at “the lazy narrative” that nature is an “inconvenience to delivering housing”.

It also identified other blockers, such as skills shortages and a lack of incentives for green homes.

The report also stated that the Planning and Infrastructure Bill was not sufficient for the Government to meet its environmental and housing targets.

Developer and supply chain updates

Crest Nicholson cut its full-year profit expectations, warning adjusted pre-tax profit will come in at the low end of or slightly below its £28m–£38m range after a subdued summer and uncertainty ahead of the Budget.

Completions totalled 1,691 units, open-market sales rose 5%, and sales rates softened toward year-end, prompting the business to accelerate its “Project Elevate” transformation plan, including consulting on the closure of a divisional office and around 50 potential job cuts.