Halifax house price index reports new high

Mortgage lender Halifax has reported that the average property price is now £300,077, rising above £300,000 for the first time.

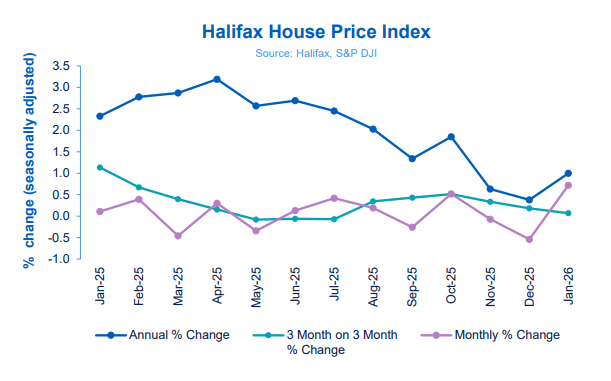

The bank’s house price index for January showed a 0.7% increase in house prices in the month, following a -0.5% fall in December.

Annual growth is now at 1.0% (Dec: 0.4%).

Regional differences in house price performance have become more pronounced, with a clear north/south divide.

Northern Ireland continues to lead the UK, with average prices rising +5.9% annually to £217,206.Scotland follows closely, recording annual growth of +5.4%, taking the average property price to £221,711.

Elsewhere, Wales saw a modest rise of +0.5% over the year, with the average home now costing £228,415.

Within England, the strongest growth remains concentrated in the north. The North West saw prices increase +2.1% to £244,328, while the North East recorded +1.2% annual growth, bringing the typical price to £181,198.

In contrast, southern regions have seen prices soften. The South East, South West, London and Eastern England all saw annual declines of more than 1%.

Meanwhile, Nationwide’s house price index for January reported a monthly change of 0.3%, and an annual change of 1.0%.

The average property is valued at £270,873.

Commenting on the figures, Robert Gardner, Nationwide’s Chief Economist, said: “Housing market activity also dipped at the end of 2025, most likely reflecting uncertainty around potential property tax changes ahead of the Budget. Nevertheless, the number of mortgages approved for house purchase remained close to the levels prevailing before the pandemic.

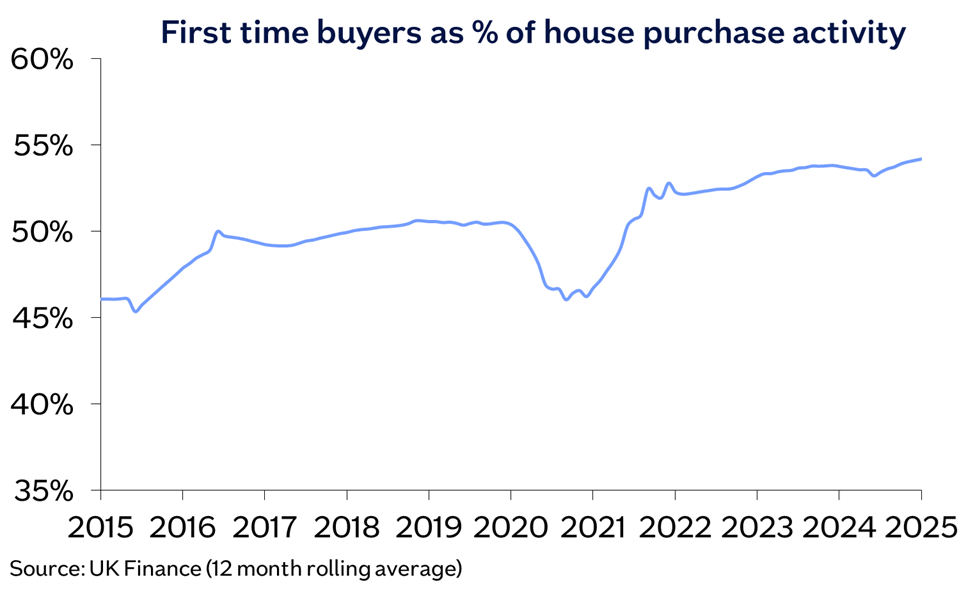

“Our recent special report highlighted that affordability constraints have eased over the past year, thanks to earnings growth outpacing house price growth and also a steady decline in mortgage rates. This has helped underpin buyer demand, with first-time buyer activity over the last year continuing to edge higher as a share of house purchases.”

Private registrations rise 12% in 2025

Latest data from the NHBC has revealed that private new home registrations rose by 12% in 2025 when compared to the previous year.

Registrations for the rental and affordable sector also increased by 10%; in total, new home registrations increased 11% last year to 115,350 new homes.

However, new home completions during the year slipped by -2% against 2024, to 122,012.

London was the only UK region not to see year-on-year growth in new home registrations.

Slowest reduction in construction activity for seven months

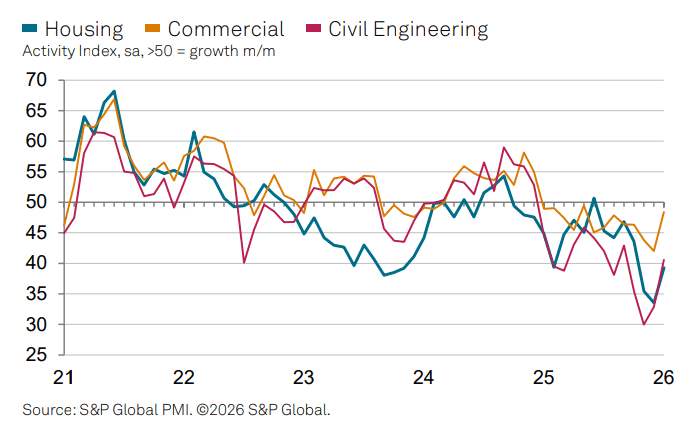

January data from the S&P Global Purchasing Manager’s Index has revealed a much slower decline in construction output than at the end of 2025.

All three sub-sectors recorded weaker rates of contraction, with the overall index reaching 46.4. Any value below 50.0 indicates a contraction in output.

Housebuilding was the weakest-performing segment in January, recording 39.3. However, the pace of contraction eased to its slowest for three months.

Meanwhile, the latest Red Flag Alert report from insolvency specialists Begbies Trayner Group (BTG) has found that the number of businesses experiencing ‘critical’ distress in the construction sector had increased over the year by 46.1%.

There were also 108,213 construction firms found to be in ‘significant’ distress – a 10.9% increase on the previous year.

BTG managing partner Julie Palmer said: “The construction industry and its supply chain may have held its breath for too long in the final quarter of 2025. The slowing of projects, subdued demand from clients and lack of confidence across the economy waiting for some relief from the budget has pushed companies close to the edge of collapse.”

New build homes cut energy bulls by £420 a year

A new report from the Home Builders Federation and Octopus Energy has revealed that modern, energy-efficient new build homes offer significant cost savings and major reductions in household carbon emissions compared to older properties.

The report, titled Watt a Save, compares energy usage between new and older housing stock, demonstrating that properties built to current industry standards consistently deliver lower energy consumption, reduced running costs, and a substantially smaller carbon footprint.

The findings reveal that new builds save on average £420 a year compared to older properties.

Developer and supply chain updates

Alchemy-backed housebuilder Honey said it will report turnover of £71.2m in its first full year, after completing 288 legal completions across 10 live sites in Yorkshire and the Midlands.

The business said it is on track to deliver 750 homes in 2026 and 1,000 in 2027, which would place it among the UK’s top 20 housebuilders by completions, supported by £160m of secured bank facilities.

–

Bellway has opened a new 135,000 sq ft timber frame factory in Sutton-in-Ashfield, Mansfield, as it moves to increase its use of sustainable construction methods.

The Bellway Home Space facility, developed with Donaldson’s Timber Systems and equipped with robotic technology from Randek, is designed to supply up to 3,000 timber frame kits a year by 2030.

–

Builders’ merchants’ like-for-like sales slipped marginally in November 2025, with the latest Builders Merchant Building Index showing total value sales down -0.4% year on year, or 5.1% on an unadjusted basis due to one fewer trading day. Volumes fell -8.5% while prices rose 3.7%, indicating continued pressure on demand despite inflationary pricing.

Performance was mixed across categories, with five of the 12 recording growth by value, led by Renewables & Water Saving and Workwear & Safetywear. However, the two largest categories declined, with Timber & Joinery Products down -2.4% and Heavy Building Materials falling -8.4%.

–

Demand for core construction materials remains at historically weak levels, according to new data from the Mineral Products Association, raising concerns over the resilience of the UK supply chain. While some products stabilised at a low base in the fourth quarter of 2025, the MPA said there was no meaningful improvement in overall market conditions.

Across 2025, demand for concrete fell -9.9%, aggregates -1.6% and asphalt -1.1%, marking a fourth consecutive annual decline, while a 5.2% rise in mortar sales masked a sharp loss of momentum in the second half of the year.