Volume developers predict reduced completions

Housebuilders Bellway and Barratt have published trading updates this week, painting a sombre outlook for the year ahead.

Bellway is anticipating a significant slowdown in the number of completions over the forthcoming year, forecasting that 7,500 homes will be built; a -31% reduction on the 10,945 homes built in the year to 31 July 2023.

Total revenue for the 2023 financial year was £3.4bn, a reduction of -3.7% on £3.5bn in 2022.

Bellway announced the closure of two business units earlier this year.

Looking ahead, our operational strength and experienced teams will enable the Group to successfully navigate a changing market, and we will maintain a clear focus on delivering high-quality homes to our customers and making further progress against the priorities set out in our ‘Better with Bellway’ sustainability strategy.

Jason Honeyman, Group Chief Executive, Bellway

Meanwhile, volume developer Barratt said the outlook for the year remained “uncertain”, as it reported a reduced net private reservation rate since 01 July of 0.46 per outlet per week (FY23: 0.55).

In a trading update for the first three months of its financial year to 08 October, the firm said it still expects to complete between 13,250 and 14,250 homes for its 2024 financial year (FY23: 17,206).

We are focused on driving revenue whilst continuing to manage build activity and carefully control our cost base. As always, we remain focused on leading the industry in building high quality, energy efficient and sustainable homes for our customers.

David Thomas, Chief Executive Officer, Barratt

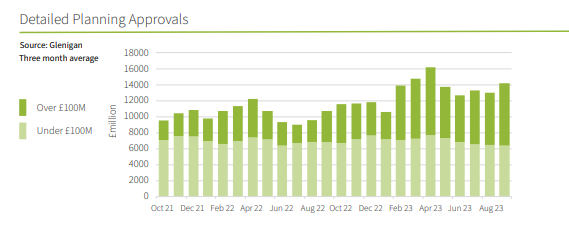

Industry monitoring firm Glenigan posted positive news this week, revealing that detailed planning approvals in the third quarter of the year were up 12% on the previous quarter and 32% ahead of 2022 levels.

However, start on sites remained weak in the quarter, down -9% on the previous quarter and -40% on 2022.

Allan Willen, Economic Director at Glenigan, said: “Starts on site continue to soften and, as economic and political disruption continues, we’ll likely see clients and contractors continue to adopt a cautious approach to start dates until the landscape looks a little less hostile.”

Lowest house price growth in October since 2008

Rightmove has published its house price index for October, revealing that the average asking price increased in the month by 0.5%; the lowest average asking price increase at this time of year since 2008.

The historic norm in October is a 1.4% increase in house prices.

The number of agreed sales is also down by -17% when compared to 2022, as sellers who are reluctant to reduce the asking price of their property find themselves “left on the shelf”.

However, the property website reported that average fixed mortgage rates have now fallen for 11 consecutive weeks, with the average two-year fixed rate now below 6% for the first time since June.

The Office for National Statistics also revealed that the North East region saw the highest annual house price increase at 3.6%, with the East experiencing the greatest fall, at -1.6%.

Housing Ombudsman reveals huge rise in maladministration findings

The Housing Ombudsman has published its Annual Complaints Review for 2022-23, revealing a 323% rise in severe maladministration findings.

Publishing individual performance reports for 163 landlords, the paper “paints a challenging picture of social housing complaints”, with property condition once again the leading category.

Too often residents with disabilities or mental health needs are falling between those gaps.

Richard Blakeway, Housing Ombudsman

Too often the basics not being done properly, with straightforward communication or record keeping being missed leading to problems becoming more severe.

This is leading to residents being treated unfairly and experiencing financial detriment or losing the enjoyment of their home.