Lloyds Group reveals forecast in latest trading update

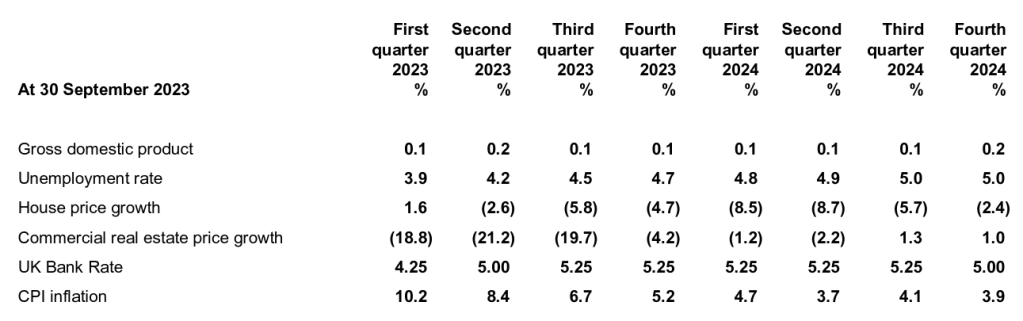

The UK’s largest mortgage lender has predicted that house prices will continue to fall in 2023 and 2024, before recovering in 2025.

In a Q3 trading statement, the firm says that house prices at the end of 2024 will be -2.4% lower than the end of 2023, due to higher borrowing costs.

The forecast, which is based on the Halifax House Price Index, also predicted that prices would rise by 0.6% in 2027.

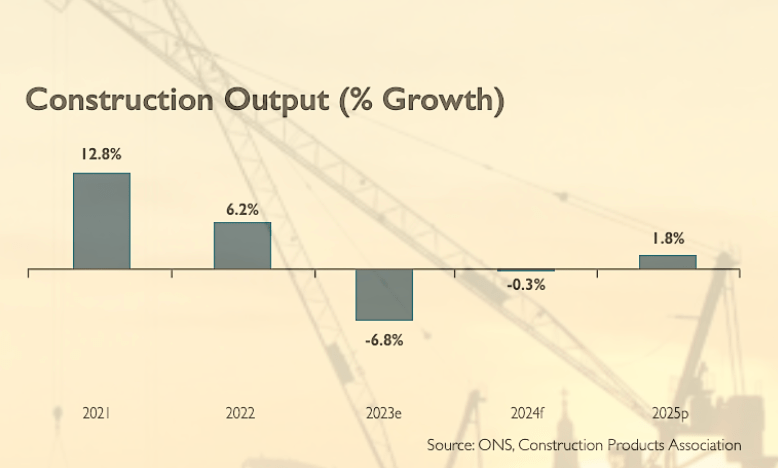

Meanwhile, the Construction Products Association’s (CPA) Autumn forecast has downgraded the expected recovery in construction next year, and warns that the industry may remain in recession until 2025.

Contractors can expect a -6.8% contraction in output this year, with a more modest fall of -0.3% in 2024.

A year ago, the CPA predicted that construction would grow by 0.7% in 2024.

The CPA called for a “positive policy stimulus in the Chancellor’s Autumn Statement” to support demand next year, after “a difficult year for construction”.

Both new build housing and rm&i have taken a significant hit from rising interest rates, falling real wages and weak economic growth.

Rebecca Larkin, Head of Construction REsearch, CPA

Although further rises in interest rates now appear off the table, the prospect of rising oil prices keeping inflation elevated suggests rates are likely to remain at peak for longer and throughout next year.

This will keep demand subdued for house purchases and improvements.

The difficulties faced by the industry in 2023 are also borne out by the number of domestic energy performance certificates (EPC) recorded, which has fallen by -8% year-on-year.

Latest Government data shows that 391,000 domestic EPCs were added to the register from July to September this year.

New-build EPCs fell by -6% over the year, with 59,000 homes logged in the same period.

In the twelve months to September 2023 there were 237,000 EPCs for new-build dwellings; a -4% annual fall when compared to the same period a year before.

Levelling Up Bill becomes law

Michael Gove’s Levelling Up and Regeneration Bill received Royal Assent this week, meaning that it is now law.

The legislation seeks to overhaul the planning system and reform developer contributions, as well as encourage more councils to put plans in place to build new homes.

It will deliver revitalised high streets and town centres. A faster and less bureaucratic planning system with developers held to account. More beautiful homes built alongside GP surgeries, schools and transport links, and environmental enhancement.

Michael Gove MP, Secretary of State for Levelling Up, Housing and COmmunities

Communities taking back control of their future with new powers to shape their local area. And our long-term levelling up missions enshrined in law.

Vistry reports “good progress” in partnerships strategy switch

Housebuilder Vistry has published a trading update from 01 July to date, revealing an adjusted profit before tax of £450m for 2023 and reporting “good progress” in its strategy to focus on its partnerships model.

The firm also reported “productive discussions” with its supply chain to agree cost reductions, as well as a revised operating structure which will see a reduction of five business units and the loss of around 200 jobs.

Building products sales slow

The latest Builders Merchant Building Index has reported a slowdown in sales over the year to August, with volumes down by -10.5% over the period.

The report, produced by MRA Research, also revealed an easing in inflation and prices, with builders’ merchant prices up by 8.0% in August 2023 when compared to the same month in 2022.

Month-on-month, total merchant sales were down by -1.9% in August, with volume sales reducing by -3.2%.

Housebuilding has been an even damper squib. Despite a pause on interest rate rises, net mortgage approvals fell again in August.

Mike Rigby, CEO, MRA Research

With people staying put, the repair, maintain and improve market offers the best opportunities for growth in the short to medium term. Britons have got the message: now’s the time to ‘improve not move’.